Investment banking is a coveted sector to enter for any finance graduate across the world, but it’s considered difficult because of the extensive skillset you need to acquire before you even appear for your first job interview. The pay is incredibly handsome in the said sector, and therefore, the intense competition for the job roles advertised at the top banks, globally.

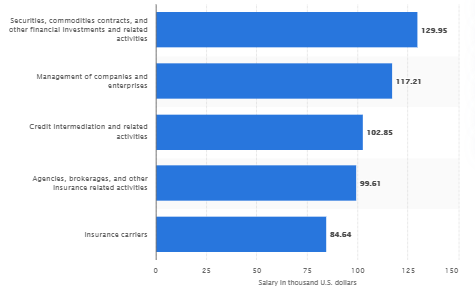

Median yearly salary of financial advisors in the U.S. (2018), by industry

Source:Statista

As per Statista, the globally-renowned German market research firm, the average salary of a financial advisor in the U.S. employed across the sub-divisions of investment banking, such as securities and commodity contracts, happened to be $129,950 annually in 2018. This was in 2018, and hence, you can expect the salaries to be at least 10 to 15% higher than what it was two years ago.

What Does Investment Banking Entail?

It primarily involves offering investment advice to wealthy investors (high-net-worth individuals and public fund institutions) who are usually the most vital clients of any investment bank. Banks generate revenues for themselves by charging advisory fees from such clients that seek expert guidance before investing huge sums of money in the financial markets.

Corporate clients are another big source of income for investment banks, to whom they offer advisory support across a variety of sub-functions in the banking sector. These typically comprise M&A, restructuring, debt or equity raising, LBOs (leveraged buyouts), among many others.

Sub-Divisions in the Investment Banking Functions

As an investment banking newbie, you can join one of the many sub-functions within the said sector. Below, we are stating all of such sub-functions of banking that you can join based on your preference and interests.

Banking Industry Groups

These individuals are generally managers who take care of the bank’s relationships with the clients. They are required to converse with clients to source business deals. Such banking professionals take product specialists along with them in the client meetings who would then pitch a particular product before the clients.

A majority of banks target their client’s basis their total revenue turnover, and the industry they belong to. Most preferred industries by investment banks include retail, healthcare, TMT (teclecom, media, and technology), industrial, financial institutions, energy and utilities, natural resources, and a few others.

Product Groups

These constitute product experts whose primary job is to concentrate on one specific product, or a service.

M&A: Banking professionals active under this sub-function offer advisory services to clients seeking acquisition or a tie-up with some other firm. Target firm and the buyer, both rope in investment banking advisors for the same.

Debt Markets: Raising debt from the bond markets, the biggest source of fund-extraction across the developed economies of the world.

Leveraged Financing: This sub-functiion in the banking sector deals with large debts for executing strategic corporate deeds, such as recapitalisations, acquisitions, capex, among others.

Equity Markets: Fund-raising happens in the said market with issuance of equity shares via FPOs, IPOs, etc.

Restructuring: When an organization wants to dramatically change its capital infrastructure in the event of not being able to handle debt payments, it’s called restructuring.

Back/Middle Office: Thousands of people work under this branch of banking at large investment banks. The job functions they handle under this sub-division of investment banking comprise – IT, compliance, HR, treasury, marketing, operations, accounting & finance, in-house legal, and risk management.

Breaking into the Investment Banking Sector: The Prerequisites

Academic Requirements

The most vital qualifications recruiters seek among the applicants in the investment banking industry sector is consistency. It’s not limited to just banking, the other demanding sectors such as medical and corporate law, too, look for the same personality trait among the candidates. Consistency becomes crucial as these jobs are highly demanding in nature, and soft skills such as decision-making ability and work ethics can make all te difference between a profitable and a struggling bank.

As an investment banker, you can’t afford to perform exceptionally well for three months, and then have your performance go downhill for the remaining nine months of the year. And that’s the reason academic performance is scrutinized so closely. The largest investment banks globally, hire finance graduates from the top B-schools for this very reason. They know that the students there have been consistent all their life in terms of ‘delivering’.

Drafting an Ideal CV

Before we start our discussion on building ideal CVs for banking jobs, let’s first take a look on the two vital facts concerning the role and significance of resumes in job-hunting in the financial sector:

- A recruiter is only going to spend 7 seconds or less on reading your CVs.

- Your immediate competition must have spent at least 50 hours or more on perfecting each line on their respective CVs.

To successfully draw the recruiter’s attention on your CV, firstly, you would need to mention some reputable brands like DARPA or Jet Propulsion Lab, or others, having similar reputation. Even a remote association with any big brand needs to be stated on the CV. You can check out a monogram resume to help you create a specific resume for your career need. You must make them bold so that they pop out to the eye of the recruiter, or use bullet points to mention such kind of information about you. The hr professional will definitely be attracted to such impactful details.

The other ways of getting the recruiters’ attention on your CV, is mentioning about the professional certifications that you have acquired while pursuing your college degree. Mentioning about interships would certainly help.